Real Estate Outlook

Economic performance

COVID-19 pandemic ignited an economic crisis unheard of since the end of WWII: during 2020 GDP fell by 8,9%, an extent larger than the one recorded during the 2008-2013 double recession caused by the crises of subprime debts and public debt.

The recession hit internal demand more extensively than foreign demand, due to the restrictions imposed by the pandemic on life and operations of families and companies. Fixed investments fell by 9,2%, albeit with a smaller impact within the construction sector (-6,6%), due to the performance of companies’ buildings sector (-4,2%) rather than residential sector (-8,8%).

However, Q4 2020 and the first months of 2021 left us with some elements to be analysed:

- The global economy, and individual advanced economies, closed 2020 with better performances than what was estimated few months ago: this is a sign of a good reaction of the global manufacturing system.

- The first months of 2021 show a clear turn in the indicators related to business expectations. Variables positively correlated with growth expectations, such as copper, oil and stock exchange indexes, recorded a sharp growth. After months of negative expectations, 2021 brought positive feelings among businesses.

- In Italy, in the first months of 2021, there has been a significant recovery driven by manufacturing. However, as in the rest of the world, it is looking like a K-shaped recovery, in which a part of the country can pick up growth, while the weaker components continue to fall, as shown by the increase of poverty in Italy.

Real estate performance and outlook

The effect of the pandemic on the economy were partially reflected on the real estate performance in 2020. The picture is less dramatic than what market fundamentals allowed to forecast few months ago, both regarding the retail and corporate market, thanks to the second semester performance.

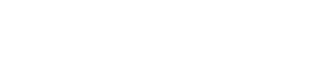

In Italy, the business’ buildings component remains the weakest part of the real estate market, compared to the residential one. Despite the transaction growth during 2019 led us to expect an expansive trend, it was not the case due to the pandemic. As of for residential buildings, the business’ real estate units’ performance was less negative in terms of transaction during the second half of 2020 (-8,3%), compared to the first half (-25,1%). In the office segment, the transaction decline brought the market to 9.463 units sold (-10,3%), while the retail units drop was higher at -14,4% (31.139 transactions).

In Milan, the decrease of office transactions was of more than 26% in 2020 compared to 2019, with the impact of the pandemic harder than in the capitals of the other northern metropolitan areas (Turin, Bologna, Genoa, Venice), where the drop was on average -5,7%.

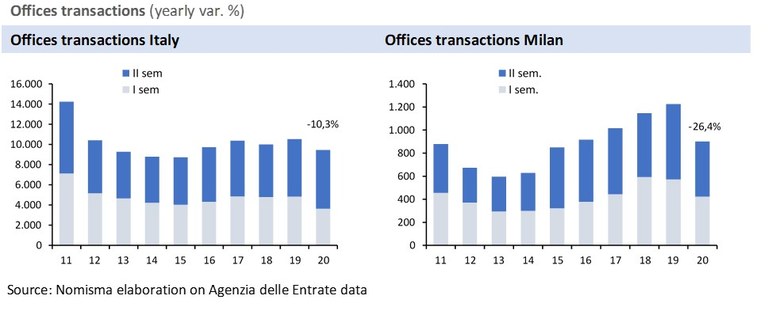

However, there is a new phenomenon: the trend of the city of Milan is not the same of the rest of the metropolitan area, which surprisingly showed a positive performance in the office sector (+2,6%) during the pandemic year. Looking at prices, during the first half of 2021 in larger cities average prices are declining for offices (-1,7%) and shops (-2,3%), while in intermediate towns the same indicators record -1,5% for offices and -2% for shops. Milan confirms the resilience of its market, limiting the decline to -0,8% for offices prices and -1,6% for shop prices. Office rents, which have been growing in Milan since 2017, are almost flat at -0,1%, compared to -1,0% in other larger cities and -1,2% in intermediate towns.

Over the next three years, higher reduction of prices are forecast for the business-related real estate units, compared to residential ones. While 2021 will still show a decrease of prices, during 2022 Milan will lead the upshift of prices, with other territories following in 2023.

Corporate market performance and outlook

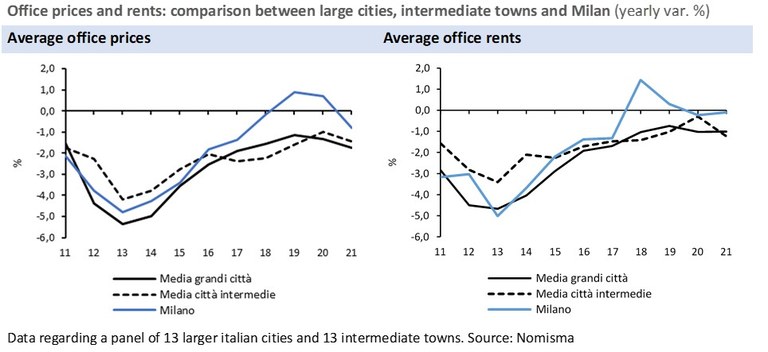

The corporate market showed in 2020 a 28,4% drop in investments, compared to the record year of 2019, with a total of 8,8 billion euro. The reduction was mainly due to strong divestments by foreign investors, only partially compensated by new investments. The balance was negative for the first time since 2011, signalling a temporary new composition of the Italian market, in which the weight of domestic investors (48%) cannot compensate the levels of previous years.

During Q4 2020, investment volumes partially recovered what was loss during the first part of the year, with 2,9 billion euros invested in the national market. The Italian investment market weights 3,2% of the total corporate asset allocation at the European level. Over the next few years, a slow recovery is expected, with a forecast of 9,5 billion euro in 2021, followed by a recovery to pre-pandemic levels between 2023 and 2024.

There is still a strong interest for “alternative” asset classes, such as residential care homes and traditional residential (albeit less than in the resto of the European market), while hotels was strongly penalized (down to 1 billion euro invested in 2020 from 3,3 billions in 2019). The composition of the investment saw offices still as the larger part (38%, even if decreasing from previous years), followed by logistics (18%) and retail (13%). Alternative asset classes weigh 32% of the total investments.

Despite a slowdown, Milan continues to be the most appealing market. During 2020, the corporate real estate market in Milan was worth 3,9 billion euro, with a reduction of 21,6% compared to 2019. The Milanese office sector is the most significant component, worth 2,5 billion euro, equal of 64% of the total investments in this segment.

For constant updates on the economic performance of our territory you can refer to Assolombarda Research Department.

For further data and analysis on the real estate sector, Nomisma’s products are available, starting from the new Osservatorio Immobiliare, which will be presented in July 2021.